Why your FSA is basically a holiday discount

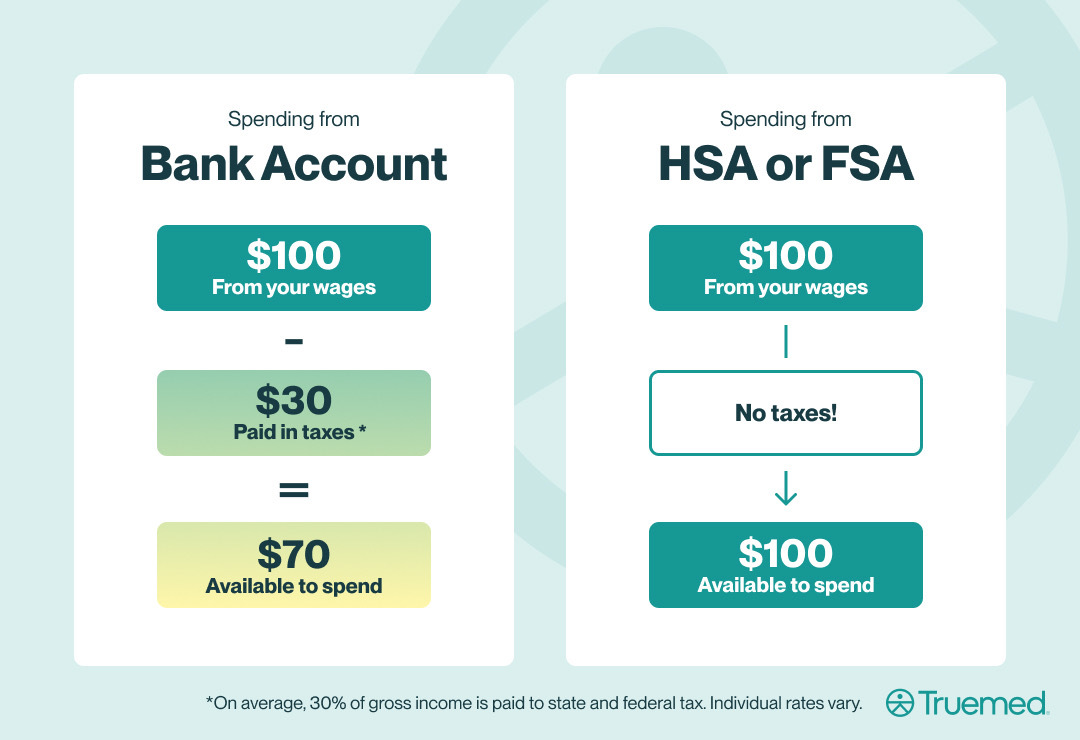

Flexible Spending Accounts (FSA) use pre-tax dollars. That means you’re paying with money that hasn’t been taxed—often worth ~30% in effective savings depending on your tax bracket. When applied to a TheraPexa Neck & Shoulder Massager, that’s like an instant seasonal sale (on top of any promo we’re running).

Important: Most FSAs are “use it or lose it” by December 31. Some plans offer a grace period or small carryover—check your plan.

The holiday clock is ticking

-

Dec 31 FSA deadline: Don’t let dollars vanish at midnight.

-

Shipping cutoffs: Order early to beat carrier delays and gift with confidence.

-

Stock levels: Our holiday rush is real—secure yours now.

How to use FSA on TheraPexa (2 easy ways)

-

Pay with FSA card at checkout (if your card is enabled).

-

Use TrueMed: Buy normally, answer a quick health questionnaire, and use FSA funds for reimbursement. Many customers see ~30% effective savings with pre-tax dollars.

Why TheraPexa is FSA-worthy

-

Deep-tissue kneading + optional soothing heat

-

Ergonomic, cordless, portable (home, office, or couch-time with cocoa)

-

10-minute auto session = realistic, consistent relief

Real life holiday use cases

-

Post-travel stiffness after long flights

-

“I’ve been wrapping gifts for 3 hours” shoulder knots

-

Desk-jockey posture aches during year-end crunch

Quick FAQ

Does FSA money expire?

Usually by Dec 31. Some plans have a grace period or carryover—check yours.

Can I gift an FSA purchase?

You typically need to use FSA funds for you/eligible dependents. If gifting, pay normally and encourage the recipient to explore HSA/FSA eligibility on their own.

What if my FSA card doesn’t go through?

Check out with a regular card and use TrueMed’s reimbursement flow.

1 comment

I ordered from them back in December as a Christmas gift. Received in mid-January. The massager itself is not good. it does get your trap but it also massages your neck area too much. I know people leave silly complaints/reviews but it massages your carotid artery too much. Feels like in an unsafe/painful way. Additionally, once I received I decided I wanted to return. 6 emails later to their support inbox I have received no communication-no other way to communicate with them either. Tried to call the number on the credit card details as well and nada. On you if you buy from them.