FSA vs. HSA—fast comparison

-

FSA: Pre-tax dollars, often expire Dec 31 (“use it or lose it”). Some plans allow a small carryover or grace period—confirm with your employer.

-

HSA: Pre-tax dollars that roll over year to year. No year-end expiration pressure.

Bottom line: If you have FSA funds, use them before Dec 31. If you have an HSA, you still get substantial pre-tax savings by buying now (and you avoid holiday stock/shipping crunch).

Why TheraPexa belongs in your benefits plan

-

Deep-tissue kneading mimics real hands for meaningful relief

-

Optional heat melts tension faster—great during winter

-

Cordless and portable—use it anywhere your holidays take you

How to check out (3 routes)

-

FSA/HSA card at checkout (if supported)

-

TrueMed reimbursement after a standard purchase—fast, guided process

-

Manual claim via your FSA/HSA portal with your receipt

Year-end checklist (print or save)

-

☐ Confirm your balance (FSA first—deadline is usually Dec 31)

-

☐ Verify eligibility (TheraPexa Neck & Shoulder Massager)

-

☐ Choose payment method (FSA/HSA card, TrueMed, or manual claim)

-

☐ Order before shipping cutoffs (beat carrier delays)

-

☐ Save receipts (for records or reimbursement)

-

☐ Set a habit: 10 minutes/day for lasting results

Holiday timing tips

-

Earlier = better: Carriers surge mid-December.

-

Gift-ready: Packaging is compact and easy to wrap.

-

New Year routine: Start now, feel better by January.

FAQ

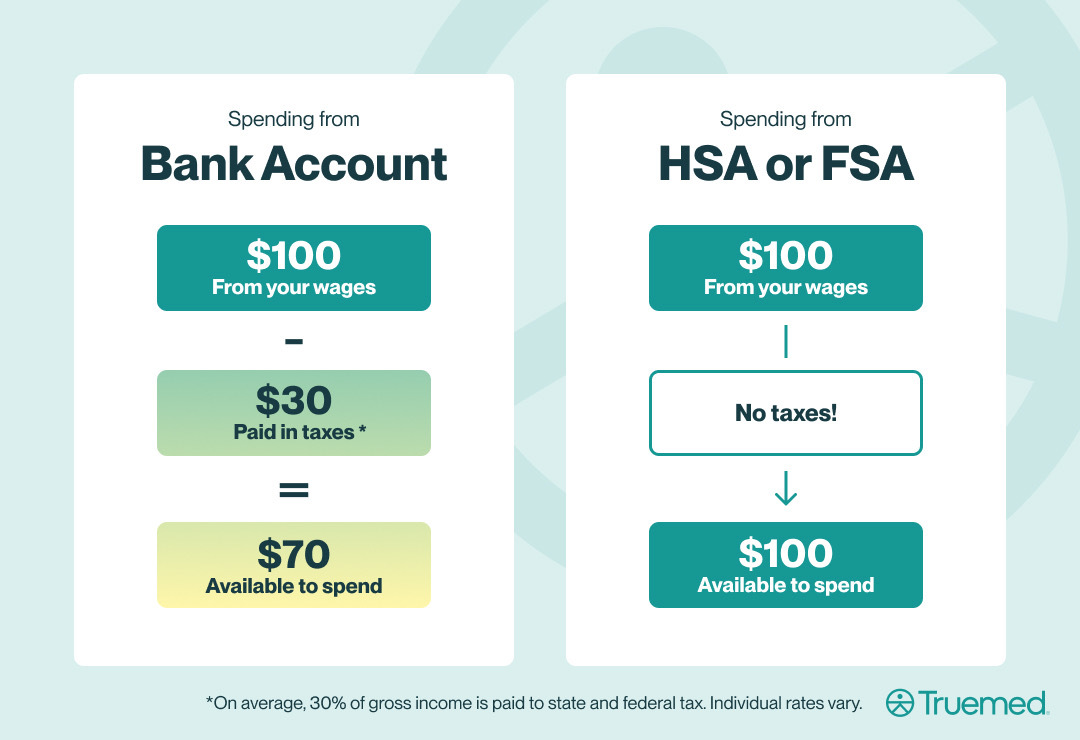

How much can I save?

Pre-tax FSA/HSA spending often equates to ~30% effective savings, depending on your tax bracket. Exact savings vary by individual.

What if my FSA expires?

Many plans end Dec 31. Some allow a small carryover or grace period—check your plan details.

Can I buy for someone else?

FSA/HSA rules usually limit spending to you or eligible dependents. For gifts, purchase normally and skip the tax-advantaged funds.

10 commentaires

I ordered from them back in December as a Christmas gift. Received in mid-January. The massager itself is not good. it does get your trap but it also massages your neck area too much. I know people leave silly complaints/reviews but it massages your carotid artery too much. Feels like in an unsafe/painful way. Additionally, once I received I decided I wanted to return. 6 emails later to their support inbox I have received no communication-no other way to communicate with them either. Tried to call the number on the credit card details as well and nada. On you if you buy from them.

Awful customer service. Contacted multiple times for a return and followed the instructions on website and receipt but have heard nothing. The 90 day refund window is closing in quickly. Off to BBB, AG, and google to submit a review and complaint.

A total scam. I ordered over a month ago, with no reply back from the company on where my order is and multiple emails sent. DO NOT ORDER FROM THIS COMPANY!!!!

I’ve ordered 2 for Christmas gifts on the 8th of December and NOTHING!!! I’ve received several emails about how it’s shipping, and still no package!! I’ve been ripped off! I’m reporting this company!

This company is a scam!!! Do not order from them. I ordered on November 28th and never received the massager! I have tried emailing them 5+ times and no response.